Home Page

Real Estate—Bargain Sale

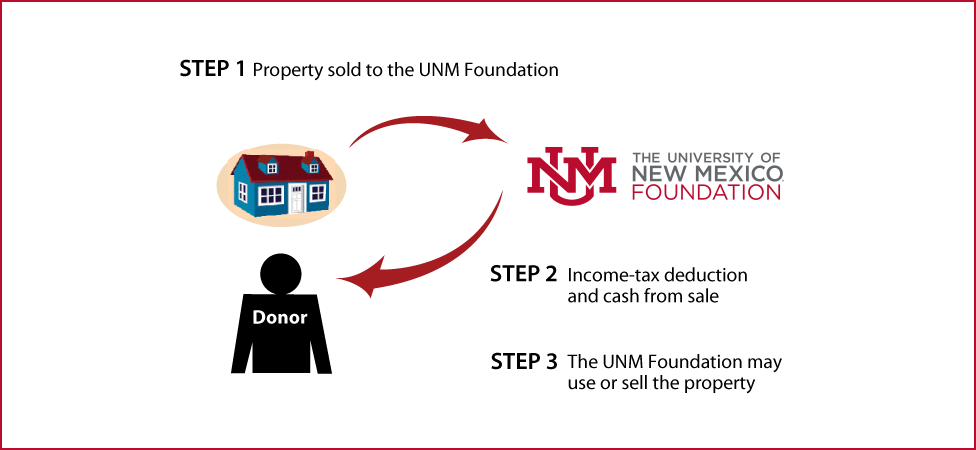

How It Works

- You sell property to the UNM Foundation for less than its fair-market value—usually what you paid for it

- The UNM Foundation pays you cash for agreed sale price, and you receive an income-tax deduction

- The UNM Foundation may use or sell the property

Benefits

- You receive cash from sale of property (sale price is often the original cost basis)

- You receive a federal income-tax deduction for the difference between the sale price and the fair-market value of the property

- The UNM Foundation receives a valuable piece of property that we may sell or use to further our mission

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Jen Jelson, Planned Giving, Estates and Trusts Project Officer |

The University of New Mexico Foundation |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer